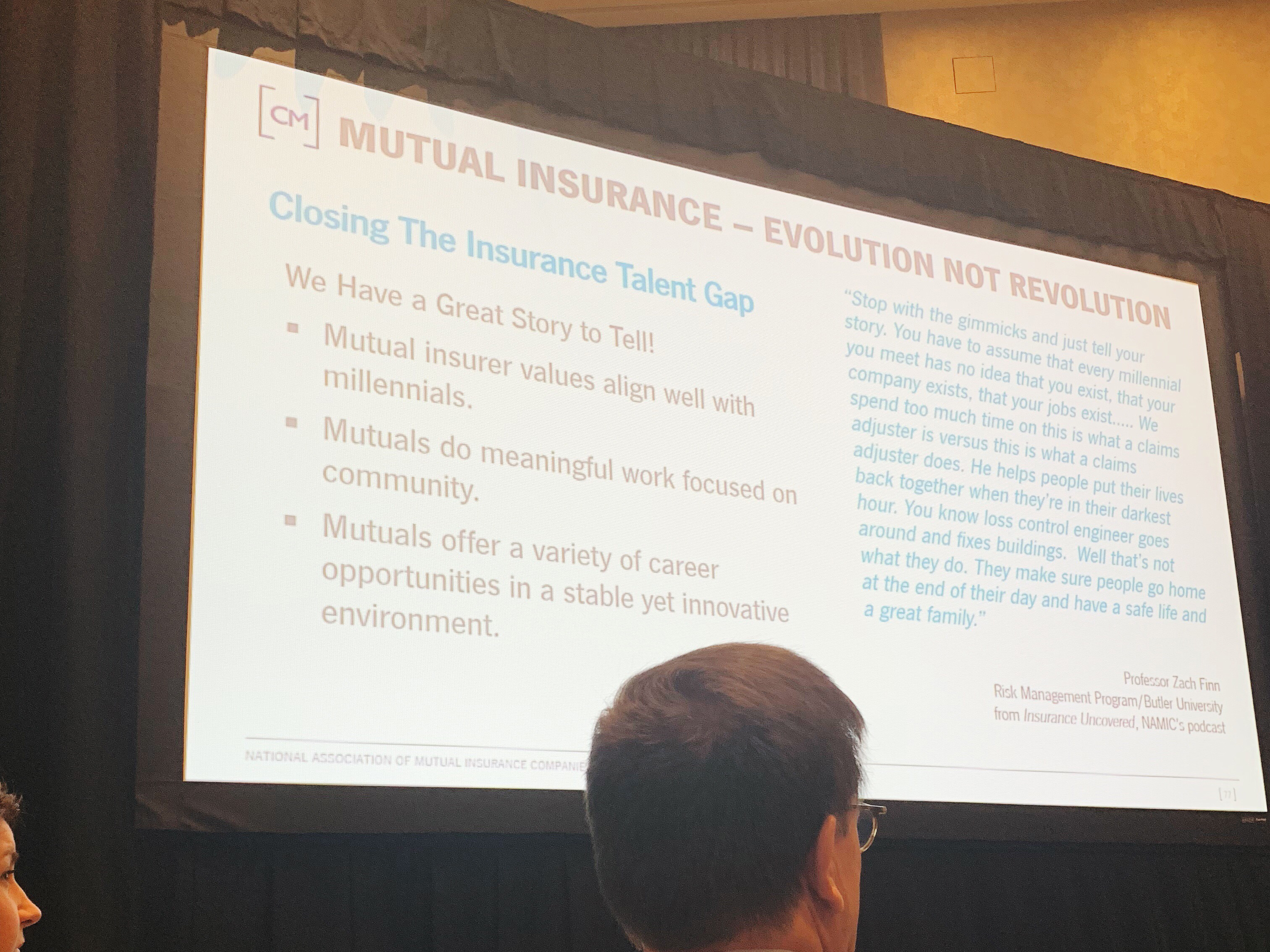

This past week, the BMI Marketing Team, along with our CEO, traveled to Chicago, Illinois, to learn from industry experts at the 2018 Marketing & Communications Workshop, hosted by the National Association of Mutual Insurance Companies (NAMIC).

Speakers offered valuable and unique insights on client interactions and communication techniques, and topics included ways to improve agent-carrier relationships, how to develop meaningful content, and what to expect when engaging with the next generation of producers. Outside of developing insurance solutions tailored to the individual, our top priority is to our agents and our loyal customers. Having the opportunity to learn from industry leaders on genuine and transparent communication practices will help us cultivate more productive and meaningful relationships with our insureds, moving forward. Below are just a few of our key takeaways from the 2018 conference:

- Emerging Industry Trends:

With the ever-evolving culture within the U.S. and even within the state of Missouri, new trends in user behavior and insurance needs are constantly emerging. Keeping up with these findings and acting on them is a large part of how we keep our insureds safe on the road and in their homes. Speaker Neil Alldredge focused on the auto industry by discussing the impacts of rising trend factors on automobile accidents. While the modern-day convenience of technology may seem like an exciting time of advancement and growth, distracted driving has risen dramatically as a result. With 94% of auto accidents being attributed to driver error, the cost of using a cell phone behind the wheel is often much higher than just the price of repairs. Understanding that any driving distraction can cause impairment much like the effects of alcohol and drugs, we feel an obligation to increase our educational efforts on the topic of safe driving for our insureds.

- Content that Meets the Needs of our Insureds:

Successful content delivery is only achieved when the information meets the demand of the audience. We have always made it a point to provide meaningful and industry-specific content to our insureds by paying attention to rising trends and recent news within the field. Conference speaker, Kelly Donahue-Piro, spoke on the importance of listening not only to the industry, but to the individual as well. This sparked several ideas for communicating with our specific audience more holistically, moving forward. We have begun brainstorming the various ways we may gather insights on what you, the consumer, need to know or wish to understand more clearly. With all of these new avenues for communication, we can only expect to increase our already-impressive customer satisfaction rating.

- Technological Disruption in Traditional Communication Efforts:

According to conference speaker Christopher Paradiso, “Technology has raised expectations, increased the speed at which business is conducted, and raised the bar for the customer experience.” With digital marketing efforts reaching further than ever before within our company, BMI now has multiple media outlets that allow us to engage with our insureds. Since the development of our social media channels, insureds have had multiple avenues of sharing feedback and interacting with our brand on a more personal level. In addition to implementing these channels to our insureds, we have increased the amount of policy-related information on our website by creating several new pages and enriched our visits with agents by sharing the current and upcoming changes in our marketing initiatives.

We’re Setting the Bar High For 2019, But We Can’t Wait to Raise It.

Two attributes never seem to waver on the importance scale for those shopping for insurance. People want to know how they may save money on a policy and how to avoid claims that might raise those rates. We are excited to continue growing our goals to meet the needs of our insureds in the coming year.

With so many options for insurance, pricing has to be competitive. Rates for each product are affected by a variety of factors, but the average for these prices must be judged to determine our competitive edge. This is why we make it a point to analyze these factors, allowing us to stay ahead of the curve and continue offering our high-quality coverage at an affordable cost to you. We also offer several discounts to lower your bill as well as endorsements to add valuable coverage to your plan for an unbeatable price. Our goals to increase the value of our products are ever growing, solidifying our standing as one of the top providers in the state. We can’t wait to see what next year brings when it comes to our unmatched service and increasingly reasonable prices.

With the recent inclusion of two new Field Inspectors, our risk aversion efforts have seen a notable increase. Our goal in adding these positions has been to protect homes from future claims by offering suggestions for improvements and loss-prevention techniques to our insureds. In addition to these efforts, our claims staff meets regularly to discuss best practices for resolving different claim types and improving the overall service provided. We are constantly coming up with new ways to protect our insureds and keep them informed on how they may make the most out of their BMI policy.

We are so excited to see the dynamic growth that 2019 is expected to bring. Learning from other leaders in the insurance industry is such a beneficial experience, and it is for that reason that we continue to participate in nationwide seminars and meet with industry trendsetters. We would like to extend a BIG thank you to NAMIC for hosting such a valuable event.